Top Story

The European Coliving Best Practice Guide

The Best Practice Guide has been formulated to provide greater insight into the rapidly evolving coliving sector across Europe.

October 19, 2022

ULI and JLL’s new report offers recommendations for coliving to unlock the great potential provided by powerful economic and demographic drivers.

London (19 October 2022) – With a new coliving best practice guide, the Urban Land Institute (ULI) and JLL provide guidance for a rapidly evolving European coliving sector. ULI and JLL’s new report offers recommendations for coliving to unlock the great potential provided by powerful economic and demographic drivers, while overcoming some of the barriers that the sector has been struggling with so far.

In recent years, the sector has emerged as a powerful tool to promote sustainable living and benefit residents, communities, and cities alike. In Europe, while starting from a very low base, the sector has witnessed rapid growth, with investment of roughly €1.2 billion from 2020 to mid-2022 into coliving real estate, with further capital commitments backing the expansion of operational platforms.

The guide offers detailed insights and best practice examples to support the real estate industry and other stakeholders with specific recommendations regarding policy frameworks for coliving developers, design and development of coliving schemes, operations and technology, and financial metrics to improve transparency.

Some of the key recommendations from the report include:

The report argues that more and more cities struggle to provide appropriate, affordable housing for a rapidly growing urban population, increasingly made up of small and single households. The report draws on new research to uncover that coliving provides a powerful opportunity to address housing challenges, offering tailored, engaged living for smaller and single households, often new to a city. The existing housing stock in these cities is often not tailored to these groups, even less so when considering the social issues that they encounter such as loneliness or lack of a social network.

The report highlights the opportunity for coliving to recognise the ESG gains that can be achieved from sharing amenities and public spaces and converting disused buildings and spaces: affordability, energy efficiency, social engagement and wellbeing. On an all-cost basis (including rent, bills, subscriptions, etc), coliving is often competitive with other forms of living, especially when considering the lack of upfront required investments for furnishing of the space and deposits.

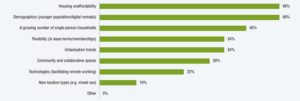

The opportunity is clearly recognised by the 175 market participants surveyed in the report with the strongest drivers for growth for the sector being housing unaffordability (49%) and the size of the younger population (49%), followed by the number of single person households (40%), a desire for flexibility (34%) and urbanisation (34%).

At the same time, the new ULI and JLL guidance acknowledges some of the challenges the sector faces, partly related to its longstanding history with the informal coliving structures, which have not always provided the best solutions for residents. The initial purpose-built coliving projects, that in practice were focused on small private spaces while lacking shared spaces and amenities, have created a perception which has not always been positive, holding back the coliving sector’s relationship with policymakers and planners.

Other barriers that market players contributing to the European Coliving Best Practice Guide identified for the further development of the sector are a lack of stock (38%) and negative planning interventions (36%), followed by limited market awareness (27%), a lack of operators (24%) and land availability (22%).

Insights from the new research highlight that although the sector has been seen mainly as providing a solution for a very niche demographic group of graduates, coliving appeals to different demographic groups, including international business travellers and active seniors who want to return to cities to enjoy easy accessibility to culture and dining experiences.

The wide demographic reach and appeal makes the potential for coliving significant and provides the opportunity for the sector to develop into a considerable living sub-sector. Coliving can be tailored to the different target groups while at the same time contributing to an increasingly demanding ESG agenda, with a focus on reusing and repurposing of existing assets, reducing the carbon footprint not only of the buildings but also of the residents and contributing to residents’ wellbeing and integration within the wider neighbourhood.

Chart: Survey responses: What are the three most significant growth drivers for the coliving sector?

Source: ULI Europe Coliving Survey 2022. Respondents could select up to three growth drivers; %s are the proportion of all respondents selecting the relevant growth driver for the coliving sector. Number of respondents = 176, totalling 471 responses

ULI Europe CEO Lisette van Doorn says, “We see significant potential for the coliving sector in Europe providing a solution that fits the demands from many diverse target groups, all interested in city living and access to shared spaces and amenities. So far, most of the focus has been on young graduates, but the potential customer base is much larger and diverse than that. At the same time, there is an ambitious ESG agenda linked to successful coliving projects, by focusing on repurposing of existing buildings and knitting the project neatly into the wider community, by connecting residents to local entrepreneurs or giving the wider community access to some of the amenities, like coworking and a gym. We have barely begun to scratch the surface in realising its true potential.

“For any project to be successful, it is important to have all stakeholders, including the developer, architect, investor, operator and planner on board as early as possible taking a long term perspective, and work closely together in implementing ESG practices and targets, adapting assets to a range of income levels, and using evidence to communicate the benefits of the sector more widely.”

“The drivers for growth in coliving are setting out a huge opportunity for the sector to create and demonstrate social value, thus unlocking more investment and changing policymakers and public perceptions about the benefits of coliving,” said Tom Colthorpe, Associate in the EMEA Living Research & Strategy team at JLL. “Our research draws on data and surveys to understand the European coliving landscape, existing stock and pipeline, demographics and investment levels, to propose key recommendations for the sector’s evolution.”

Ends

Notes to Editors

Download the European Coliving Best Practice Guide on Knowledge Finder and a summary from the ULI website here.

About the Urban Land Institute

About JLL

JLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. JLL is a Fortune 500 company with annual revenue of $19.4 billion, operations in over 80 countries and a global workforce of more than 98,000 as of December 31, 2021. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Don’t have an account? Sign up for a ULI guest account.